Three Questions That Can Predict Future Quality of Life!

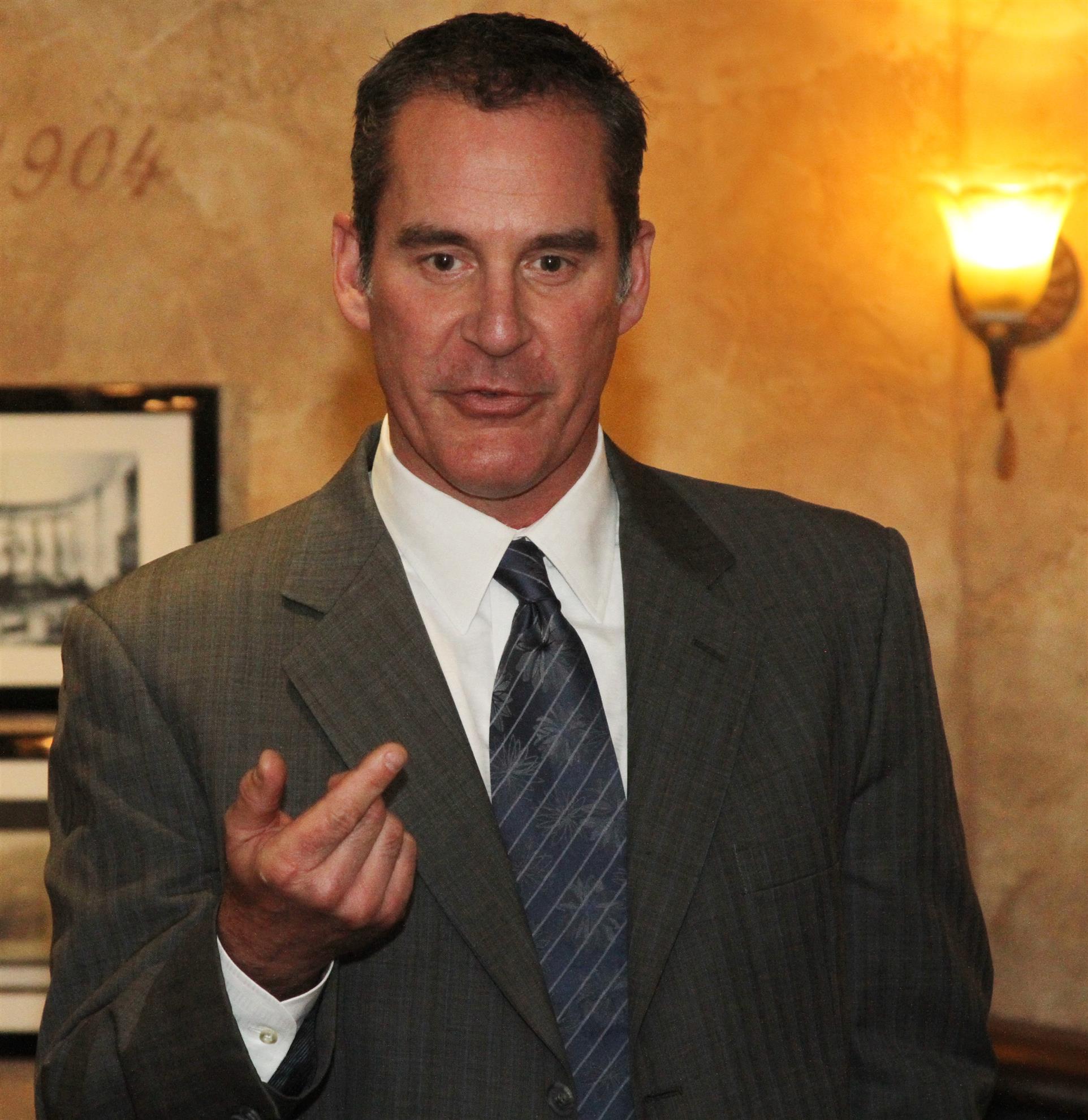

Rick Poole from CIMA Hartford MIT asked us some strange questions to ascertain the quality of our life

What are the three questions?

"Who will change my light bulbs?"

"How will I get an ice cream cone?"

"Who will I have lunch with?"

The MIT AgeLab has identified three simple questions to help you assess how prepared your clients are to live well in retirement. What do these questions have to do with retirement planning? A lot more than you may think. They actually uncover important factors that can determine your clients’ future quality of life and serve as a starting point for planning a satisfying retirement.

When it comes to retirement planning, we’re inclined to focus on accumulating assets and making sure clients spend their money wisely. But while clients’ biggest fears may be outliving their wealth, there’s an even greater risk of:

- Losing their independence due to ailing health;

- Being unable to access the big and small things that make them happy, and

- Facing a decline in the number of friends in their social network

Planning for these contingencies is an integral part of preparing to live longer, better. Integrate these issues into a comprehensive planning discussion to make an ambiguous retirement future—often decades away—more tangible to clients. This can help them commit to preparing for their retirement today.

______________________________________

Will Change My Light bulbs?

This sounds mundane and simple enough—but is it?

If your father is 85—even if he is in good shape—do you want him on a ladder changing light bulbs? How about your mom living alone and maintaining her home well into her eighth and ninth decade? Given that the baby boomers had fewer children and have the highest divorce rates in history, help at home may be in short supply.

Now, think about your own retirement years. Changing light bulbs is more than an issue of long-term home maintenance. It is a question that asks, “Do I have a plan of how to maintain my home?” When younger, most of us take for granted our ability to do daily house cleaning, maintenance, and basic repairs—even home modifications. Having clients identify the costs, as well as the trusted service providers, necessary to maintain their homes may be as critical to aging independently as the health of their retirement savings.

How Will I Get an Ice Cream Cone?

Imagine it’s a hot summer night—a perfect night for getting an ice cream cone... preferably chocolate. Quality of life is about being able to easily and routinely access those little experiences that bring a smile.

While getting an ice cream cone when you want it is not a financial strain for most, the capacity to have that cone on demand does raise questions, such as, “Do I have adequate transportation to go where I want when I want?”

If driving is no longer possible, “Are there seamless alternatives that enable clients to make the trips they want—not just those they need?” Moreover, ask clients if they’re planning to age in a community where there are ample activities and people to keep them engaged, active, and having fun.

Who Will I Have Lunch With?

Lunch is more than a meal—it’s an occasion. Who clients have lunch with may be a good indicator of their social network. This is not the social network of “friends” they have online, but friends they see on a regular basis—people who help reinforce a healthy and active lifestyle, and who they and their significant other can depend upon.

Even with adequate finances, living alone without a robust circle of social support can threaten healthy aging. Today, 36% of women over 65 years old live alone in the United States.1 Consequently, planning where, and with whom to retire may be as important as how much it will cost. For example, a home in the mountains may be alluring as clients approach retirement, but it may lead to an inadequate network of friends, or complete isolation during old age.

The baby boomers are facing a different retirement than their parents. They’re more likely to live alone, to have fewer children, and to live in suburban and rural locations that may not provide easy access to active and livable communities.